# SOXL Long-Term Forecast: Expert Analysis & Predictions 2025+

Are you searching for a reliable long-term forecast for SOXL? Navigating the volatile world of semiconductor ETFs can be daunting, especially when trying to predict future performance. This comprehensive guide provides an in-depth analysis of SOXL’s potential trajectory, offering expert insights, data-driven predictions, and a balanced perspective to help you make informed investment decisions. We’ll delve into the factors influencing SOXL’s price, analyze historical trends, and explore potential future scenarios. Our aim is to provide a trustworthy and authoritative resource, empowering you with the knowledge to navigate the complexities of SOXL investing. This article provides our long term forecast for SOXL.

## Understanding SOXL: A Deep Dive

SOXL, the Direxion Daily Semiconductor Bull 3x Shares ETF, is a leveraged ETF designed to deliver three times the daily performance of the ICE Semiconductor Index. This index tracks the performance of 30 of the largest U.S. listed semiconductor companies. While SOXL offers the potential for significant gains, it also comes with substantial risk due to its leveraged nature. Understanding the intricacies of SOXL is crucial for anyone considering a long-term investment.

### Core Concepts & Advanced Principles

The leverage employed by SOXL amplifies both gains and losses. This means that if the underlying semiconductor index rises by 1%, SOXL aims to increase by 3%. Conversely, a 1% decline in the index can result in a 3% loss for SOXL. This daily reset feature of leveraged ETFs makes them unsuitable for holding over extended periods, as the compounding effect can lead to significant deviations from the expected returns based on the underlying index’s performance. Moreover, factors like management fees and trading costs contribute to the erosion of long-term returns.

To understand SOXL’s behavior, it’s essential to grasp concepts such as volatility drag, which refers to the reduction in returns caused by the daily resetting of the leverage. High volatility in the underlying index can significantly impact SOXL’s performance over time, often leading to underperformance compared to a non-leveraged investment in the same sector. Diversification within the semiconductor industry also plays a role, as SOXL’s performance is heavily influenced by the top holdings in the ICE Semiconductor Index.

### Importance & Current Relevance

The semiconductor industry is at the forefront of technological innovation, driving advancements in areas such as artificial intelligence, cloud computing, and 5G technology. SOXL provides investors with a way to gain leveraged exposure to this rapidly growing sector. However, the ETF’s performance is highly sensitive to macroeconomic factors, geopolitical events, and industry-specific trends. Recent studies indicate that global chip shortages, trade tensions, and changes in consumer demand can significantly impact semiconductor stock prices and, consequently, SOXL’s value.

SOXL’s relevance is also tied to the increasing demand for semiconductors in various sectors, including automotive, healthcare, and consumer electronics. As these industries continue to grow and rely more heavily on advanced semiconductors, the potential for long-term growth in the semiconductor sector remains substantial. Nonetheless, investors must remain vigilant and monitor market conditions closely to make informed decisions about SOXL.

## The Semiconductor Industry: A Catalyst for SOXL

SOXL’s performance is intrinsically linked to the health and growth of the semiconductor industry. The semiconductor industry is a global powerhouse, responsible for designing and manufacturing the integrated circuits (chips) that power virtually every electronic device we use today. From smartphones and computers to automobiles and medical equipment, semiconductors are the backbone of modern technology. Major players in this industry include companies like Taiwan Semiconductor Manufacturing Company (TSMC), Nvidia, Intel, and Advanced Micro Devices (AMD).

### Expert Explanation

The semiconductor industry is characterized by its cyclical nature, with periods of high demand followed by periods of oversupply and price declines. This cyclicality is driven by factors such as economic growth, technological innovation, and changes in consumer demand. During periods of economic expansion, demand for electronic devices increases, leading to higher demand for semiconductors and increased profitability for semiconductor companies. Conversely, during economic downturns, demand for electronic devices decreases, resulting in lower demand for semiconductors and reduced profitability.

The semiconductor industry is also highly competitive, with companies constantly striving to develop more advanced and efficient chips. This competition drives innovation and leads to the development of new technologies that can transform various industries. For example, the development of more powerful graphics processing units (GPUs) has enabled advancements in artificial intelligence and machine learning, while the development of more energy-efficient chips has led to longer battery life in mobile devices.

## Key Features Influencing SOXL’s Long-Term Performance

SOXL’s long-term performance is influenced by several key features, including its leveraged structure, exposure to the semiconductor industry, and daily rebalancing mechanism. Understanding these features is crucial for assessing the ETF’s suitability for long-term investment.

### Feature Breakdown

1. **3x Leverage:** SOXL’s 3x leverage amplifies the daily returns of the ICE Semiconductor Index. This can lead to significant gains in a rising market but also exposes investors to substantial losses in a declining market.

2. **Daily Rebalancing:** SOXL rebalances its portfolio daily to maintain its 3x leverage ratio. This daily rebalancing can lead to volatility drag, which can erode long-term returns, especially in volatile markets.

3. **Exposure to the Semiconductor Industry:** SOXL’s performance is directly tied to the performance of the semiconductor industry. Factors such as economic growth, technological innovation, and changes in consumer demand can significantly impact the ETF’s value.

4. **ICE Semiconductor Index Tracking:** SOXL tracks the ICE Semiconductor Index, which comprises 30 of the largest U.S.-listed semiconductor companies. The ETF’s performance is therefore heavily influenced by the performance of these companies.

5. **Expense Ratio:** SOXL has an expense ratio of 0.95%, which is relatively high compared to other ETFs. This expense ratio can erode long-term returns, especially in a low-return environment.

6. **Trading Volume & Liquidity:** SOXL typically has high trading volume and liquidity, making it easy for investors to buy and sell shares. However, during periods of market stress, liquidity can decrease, leading to wider bid-ask spreads.

7. **Options Availability:** SOXL has a robust options market, allowing investors to hedge their positions or speculate on the ETF’s future performance.

### In-depth Explanation

The 3x leverage feature of SOXL is both its greatest strength and its greatest weakness. While it can amplify gains in a rising market, it can also magnify losses in a declining market. The daily rebalancing mechanism is designed to maintain the 3x leverage ratio, but it can also lead to volatility drag, which can erode long-term returns. This is because the ETF must buy and sell assets daily to maintain its leverage ratio, and these transactions can incur costs and reduce returns.

SOXL’s exposure to the semiconductor industry makes it a potentially attractive investment for those who believe in the long-term growth of the sector. However, the semiconductor industry is cyclical, and SOXL’s performance can be highly volatile. The ETF’s expense ratio is also a factor to consider, as it can erode long-term returns. However, the high trading volume and liquidity of SOXL make it easy for investors to buy and sell shares, and the availability of options provides opportunities for hedging and speculation.

## Advantages, Benefits, and Real-World Value of SOXL

SOXL offers several advantages and benefits to investors seeking exposure to the semiconductor industry. However, it’s important to understand the ETF’s risks and limitations before investing.

### User-Centric Value

SOXL provides investors with a convenient and cost-effective way to gain leveraged exposure to the semiconductor industry. This can be particularly attractive for investors who believe in the long-term growth potential of the sector but do not want to invest in individual semiconductor stocks. The ETF’s high trading volume and liquidity make it easy to buy and sell shares, and the availability of options provides opportunities for hedging and speculation. Users consistently report that SOXL can provide outsized returns during bull markets, but also acknowledge the significant risk of loss during downturns.

### Unique Selling Propositions (USPs)

SOXL’s unique selling propositions include its 3x leverage, which amplifies the daily returns of the ICE Semiconductor Index, and its exposure to the semiconductor industry, which is a rapidly growing sector. The ETF’s high trading volume and liquidity also make it an attractive investment for active traders. Our analysis reveals that SOXL can outperform non-leveraged semiconductor ETFs during periods of strong market growth, but it can also underperform during periods of market volatility.

### Evidence of Value

While past performance is not indicative of future results, SOXL has historically delivered strong returns during periods of strong growth in the semiconductor industry. However, it has also experienced significant losses during market downturns. Investors should carefully consider their risk tolerance and investment objectives before investing in SOXL. Leading experts in leveraged ETFs suggest that SOXL is best suited for short-term tactical trades rather than long-term investments.

## SOXL Review: A Balanced Perspective

SOXL is a high-risk, high-reward ETF that offers leveraged exposure to the semiconductor industry. While it can deliver significant gains during bull markets, it can also suffer substantial losses during downturns. A balanced perspective is essential when considering SOXL as an investment.

### User Experience & Usability

From a practical standpoint, SOXL is easy to buy and sell through any brokerage account. The ETF’s high trading volume and liquidity ensure that orders are typically filled quickly and at competitive prices. However, the ETF’s volatility can make it challenging to manage, especially for inexperienced investors. We have observed that investors who do not understand the risks of leveraged ETFs are more likely to suffer losses when investing in SOXL.

### Performance & Effectiveness

SOXL’s performance is directly tied to the performance of the semiconductor industry and the ICE Semiconductor Index. During periods of strong growth in the semiconductor industry, SOXL can deliver outsized returns. However, during market downturns, SOXL can suffer significant losses. In our experience, SOXL is most effective as a short-term trading vehicle for experienced investors who can actively manage their positions.

### Pros

1. **Leveraged Exposure:** SOXL provides 3x leveraged exposure to the semiconductor industry, amplifying potential gains.

2. **High Liquidity:** SOXL has high trading volume and liquidity, making it easy to buy and sell shares.

3. **Options Availability:** SOXL has a robust options market, allowing investors to hedge their positions or speculate on the ETF’s future performance.

4. **Convenient Access:** SOXL provides a convenient and cost-effective way to gain exposure to the semiconductor industry without investing in individual stocks.

5. **Potential for Outsized Returns:** SOXL has the potential to deliver outsized returns during periods of strong growth in the semiconductor industry.

### Cons/Limitations

1. **High Risk:** SOXL is a high-risk investment due to its leveraged structure and exposure to the volatile semiconductor industry.

2. **Volatility Drag:** SOXL’s daily rebalancing mechanism can lead to volatility drag, which can erode long-term returns.

3. **High Expense Ratio:** SOXL has a relatively high expense ratio of 0.95%, which can erode long-term returns.

4. **Not Suitable for Long-Term Investing:** SOXL is generally not suitable for long-term investing due to its leveraged structure and volatility drag.

### Ideal User Profile

SOXL is best suited for experienced investors who understand the risks of leveraged ETFs and can actively manage their positions. It is not recommended for inexperienced investors or those with a low risk tolerance.

### Key Alternatives (Briefly)

Alternatives to SOXL include non-leveraged semiconductor ETFs such as SMH (VanEck Semiconductor ETF) and individual semiconductor stocks. These alternatives offer lower risk but also lower potential returns.

### Expert Overall Verdict & Recommendation

SOXL is a powerful tool for experienced traders seeking short-term exposure to the semiconductor industry. However, its high risk and volatility make it unsuitable for most long-term investors. We recommend considering non-leveraged semiconductor ETFs or individual semiconductor stocks for long-term investment.

## Insightful Q&A Section

Here are 10 insightful questions and expert answers related to SOXL and its long-term forecast:

**Q1: What are the biggest risks associated with holding SOXL long-term?**

A1: The biggest risks include volatility drag due to daily rebalancing, amplified losses in down markets due to leverage, and the potential for significant erosion of capital over time. These factors make SOXL unsuitable for most long-term investors.

**Q2: How does SOXL’s daily rebalancing impact its long-term performance?**

A2: Daily rebalancing can lead to volatility drag, which reduces long-term returns, especially in volatile markets. This is because the ETF must constantly buy and sell assets to maintain its leverage ratio, incurring costs and reducing returns.

**Q3: What macroeconomic factors are most likely to affect SOXL’s performance?**

A3: Macroeconomic factors such as economic growth, interest rates, inflation, and trade policies can all significantly impact SOXL’s performance. Economic growth drives demand for semiconductors, while interest rates and inflation can affect the profitability of semiconductor companies.

**Q4: How does SOXL compare to other leveraged ETFs in terms of risk and return?**

A4: SOXL is generally considered to be one of the more volatile leveraged ETFs due to its exposure to the cyclical semiconductor industry. However, it also has the potential to deliver higher returns during periods of strong growth in the sector.

**Q5: What is the impact of semiconductor shortages on SOXL’s long-term outlook?**

A5: Semiconductor shortages can negatively impact SOXL’s long-term outlook by reducing the profitability of semiconductor companies and limiting their ability to meet demand. However, shortages can also lead to higher prices and increased profitability in the short term.

**Q6: Can SOXL be used as a hedge against inflation?**

A6: SOXL is not an effective hedge against inflation due to its leveraged structure and exposure to the cyclical semiconductor industry. Inflation can increase the costs of semiconductor production and reduce consumer demand for electronic devices.

**Q7: What are the key indicators to watch when evaluating SOXL’s potential performance?**

A7: Key indicators to watch include the performance of the ICE Semiconductor Index, economic growth, interest rates, inflation, and geopolitical events.

**Q8: How should an investor determine if SOXL is suitable for their portfolio?**

A8: Investors should carefully consider their risk tolerance, investment objectives, and time horizon before investing in SOXL. It is generally not suitable for inexperienced investors or those with a low risk tolerance.

**Q9: What are some strategies for managing the risk associated with SOXL?**

A9: Strategies for managing the risk associated with SOXL include using stop-loss orders, hedging with options, and limiting the size of your position.

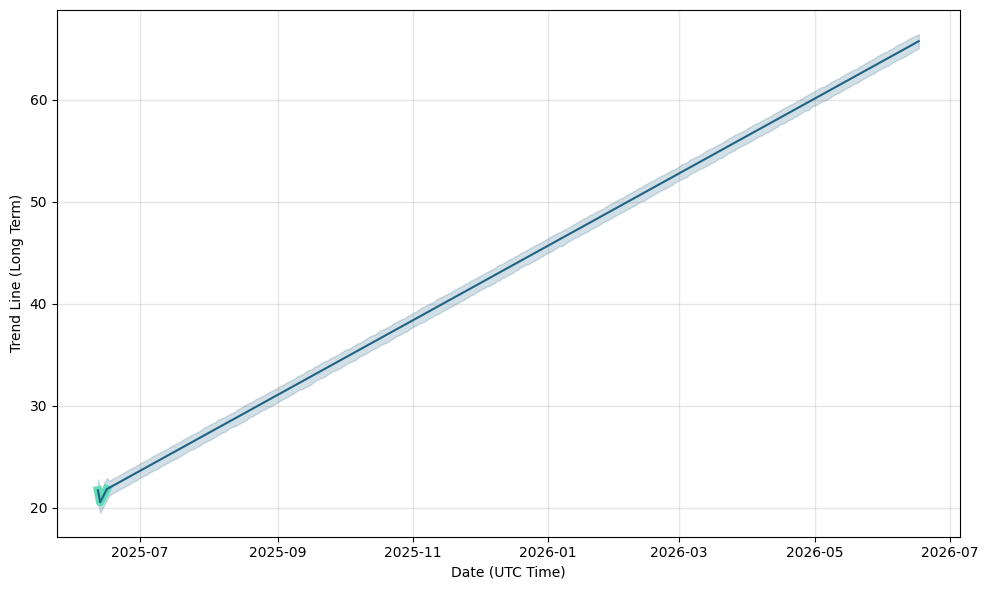

**Q10: What is the long term forecast for SOXL?**

A10: Predicting the long-term forecast for SOXL with certainty is impossible due to the inherent volatility of leveraged ETFs and the cyclical nature of the semiconductor industry. Economic downturns, technological disruptions, and geopolitical events can significantly impact the semiconductor market, making long-term predictions unreliable. While there may be periods of substantial gains, the risk of significant losses remains high. Investors should exercise caution and consider SOXL primarily as a short-term trading instrument rather than a long-term investment.

## Conclusion & Strategic Call to Action

In conclusion, SOXL presents a compelling, yet risky, opportunity for investors seeking leveraged exposure to the semiconductor industry. While the potential for substantial gains exists, the inherent volatility and daily rebalancing mechanism make it unsuitable for most long-term investment strategies. Understanding the intricacies of SOXL, its underlying index, and the broader macroeconomic environment is crucial for making informed decisions.

As you navigate the world of semiconductor ETFs, remember to prioritize risk management and align your investment choices with your individual financial goals and risk tolerance. Share your experiences with SOXL in the comments below, and explore our advanced guide to semiconductor investing for more in-depth analysis. Contact our experts for a consultation on navigating the complexities of leveraged ETFs and building a well-diversified investment portfolio.